08.12.19

PLANT-BASED POWER: LESSONS FROM NATURAL FOOD DISRUPTERS

KARL R. LAPAN, PRESIDENT & CEO, THE NIIC

Editorial credit: / Shutterstock.com

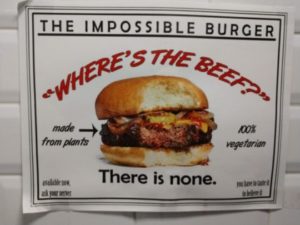

By now you’ve probably heard of the Beyond Burger and its competitor the Impossible Burger. The latter is now available nationwide at Burger King and over 5,000 restaurants nationally. According to a recent CNN article authored by Linda Drayer on August 9, 2019, “One of the Impossible Burger’s ingredients is a genetically modified version of heme, an iron-containing molecule from soy plants, like the heme from animals — which is what gives it its uniquely meaty flavor.”

As more Americans cut back on their red meat consumption and move towards more mindful eating, the purveyors of meat alternatives are capitalizing on this shift. I am not advocating for meat-alternative products just merely restating the context for my observations.

What can food startups (and those in other industries) learn from the success of such brands?

Here are three takeaways:

1. Storyliving (narrative) matters.

Finding a way to frame the genesis story, so it resonates with consumers can be a golden opportunity. Beyond Meat founder Ethan Brown has been open about his experience growing up on a farm and most recently his skepticism of meat consumption as a necessity. His message is that plant-based patties don’t have to be bland and such alternatives to meat can be healthier and better for animals and the environment. In this way, he’s found an in-road into the hearts and minds of meat-eaters, animal rights activists, and investors alike. “Storyliving is modernized storytelling where a company enables consumers to experience their brand narrative.”

2. Healthy eating is top of mind.

There has been a sea change in recent years. Most Americans have a working knowledge about the basics of a balanced diet and activity. Moreover, that’s translating to sales at the grocery store —at the expense of more traditional venues.

Consider the impact of the burgeoning natural foods movement. The health and wellness food market size is expected to grow to $280.97 billion during 2018-2022, according to Technavio. The rise of healthy meal kits like Purple Carrot, Green Chef and Sun Basket, while restaurants are struggling, underscores American’s collective mindset and purchasing shift.

3. Product development matters.

Innovation never sleeps, and these plant-based Goliaths are taking that to heart. Beyond meat has elected to invest its operating cash flow back into development, upping the ante on their commitment to marketing, production, distribution, and product development.

Also, Quorn Foods, producer of faux meat, is following suit, after experiencing an uptick in sales. The British company announced its plans to spend over $8.5M on a research and development facility at its North Yorkshire headquarters, in an attempt to keep up with the demand in light of the rise of plant-based eating and increased competition in the marketplace. Quorn’s Kevin Brennan told The Guardian his company is poised to keep up with rivals by developing its bleeding vegan burger while it aims to reach $1bn of annual sales by 2027.

What do you think? Do meat alternatives have staying power? And does the opportunity shift reflect lessons or interactions for other disrupters in other industries?